“How much money should I save to buy a house in 2024?” This key question resonates in the minds of future buyers around the world. In a constantly changing market and with property dreams on the horizon, it is essential to address this topic with clarity and precision.

Buying a home is a financial decision and an important step in life. If you are considering taking this big step, you have probably already faced this crucial question, seeking advice from friends and family who have recently gone through this process. However, the answers can be as diverse as the homes themselves.

The truth is, there is no one-size-fits-all answer. Every financial situation is unique, and what works for one person may not be ideal for another. This is where experience and professional knowledge become essential.

At Real Estate Juan C, we understand the importance of expert and personalized guidance. In this article, we will guide you through the process of determining how much you need to save to become a homeowner, taking into account your individual circumstances and long-term goals.

Table of Contents

ToggleGet ready to clear your doubts and take a firm step toward the property of your dreams. Let’s explore how much money you need to save to realize your dream of homeownership.

How much money do you need to buy a house?

1. Your Debt-to-Income Ratio: The Crucial First Step

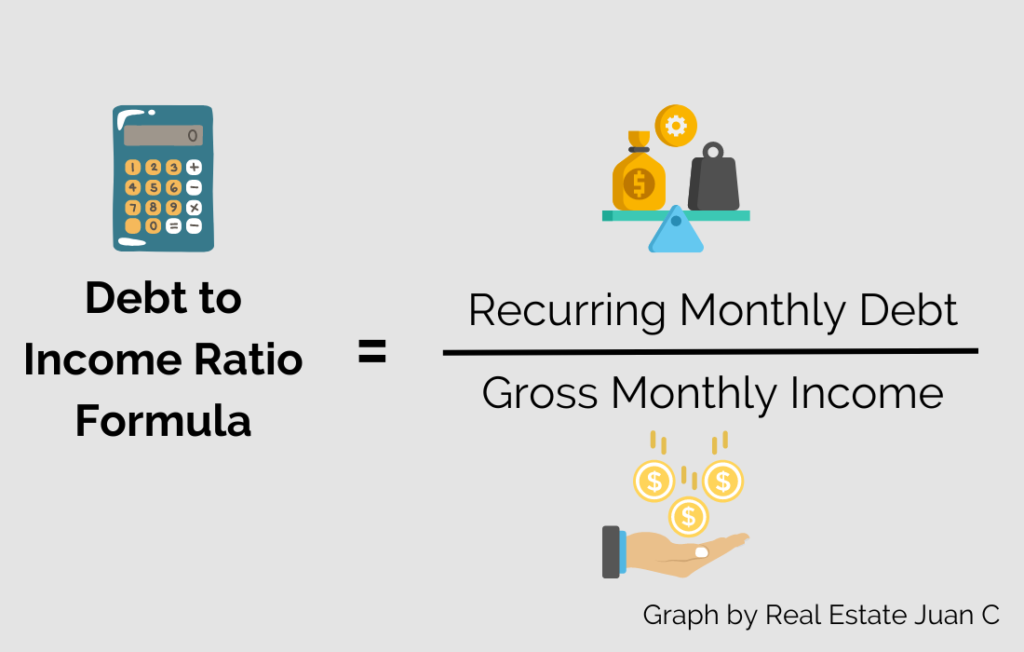

Before diving into the real estate market, it is essential that you examine your financial situation carefully. This first step involves a careful evaluation of your debt-to-income ratio, a key indicator in determining your ability to purchase a home.

What is the Debt-Income Ratio?

The debt-to-income ratio compares your total debts to your income. It’s not just about considering your current salary but also any other sources of income you may have. This ratio is a deciding factor for lenders when evaluating your eligibility for a mortgage loan.

The 43% Standard

A debt-to-income ratio of 43% is generally considered the limit to qualify for most mortgage loans. This means that your monthly debt payments should not exceed 43% of your gross monthly income. Staying below this threshold is crucial to showing that you can manage your monthly payments effectively.

FHA Considerations

The Federal Housing Administration (FHA) suggests that a borrower’s annual income should be at least twice their gross debt obligation. This includes property-related expenses such as homeowner’s insurance, property taxes, and homeowners’ association dues.

Starting Point

Answering the question, “How much money do I need to buy a house?” It starts with understanding and improving your debt-to-income ratio. By optimizing this aspect of your finances, you will be taking a crucial step toward qualifying for the mortgage you need to purchase your home.

2. Your Down Payment

The down payment is a key factor when buying a home, and we can help you better understand it. In addition, different loan options can make this process easier, such as FHA, conventional, and USDA loans. The best thing is that there are also down payment assistance programs.

We know that the down payment is a significant part of considering the purchase of a home. This is because it determines your ability to acquire it. However, you don’t have to worry as we are here to find the best solution for you.

Depending on the type of loan you choose and your credit history, you may be able to put down less than you think.

For example, buyers who opt for an FHA loan typically make a down payment of at least 3.5%. And buyers who decide to go for the conventional loan need a 5% down payment. For people with ITIN, the down payments are usually 20%. And USDA loans require no down payment.

It’s important to note that the down payment you choose will affect how much pre-tax income you’ll need. This is because it will determine the amount of money you should borrow. You should also know that the less down payment you use, the higher the total cost of the house will be at the end of the 30-year term.

Also, remember that access to these loans is determined by your credit score.

If you would like to learn more about the down payment assistance programs available now, we invite you to contact us. We are here to help you discover the options that fit your situation.

[Related Article: How to Buy a House in Massachusetts with Bad Credit]

3. Upfront Costs

Another crucial factor in determining the amount of money needed to buy a house lies in the realm of upfront costs. These costs encompass both prepaid expenses and your down payment, each playing a vital role in the home-buying process.

Prepaid expenses are distinct from closing costs, which include conveyancing fees and legal expenses associated with finalizing the purchase. Instead, upfront prepayments cover essential services such as property insurance premiums, real estate taxes, and mortgage insurance to safeguard against potential payment delinquencies.

By incorporating these recurring payments into your overall expenses, you can avoid the need to have substantial sums readily available on each due date.

Additionally, prepaid costs often include a mortgage per diem charge, which accounts for daily mortgage interest. This charge is calculated based on the closing date and typically covers the interest accrued from the closing date until the last day of the month.

It’s important to note that homeowners only pay interest in advance when per diem charges apply, while in other cases, bills are settled in arrears.

[Related Article: How To Prepare for Tax Season To Buy a House Next Year]

4. Closing Costs

There are many different costs involved when you get a mortgage. In recent years, some of the most significant have been the appraisal fee, credit report fee, origination fee, application fee, title search fee, title insurance policy fee, and subscription.

The amount you pay can be between 2% to 5% of the house’s value, depending on what is charged. The average borrower paid $6,087 in closing costs and fees in 2020. These charges cover paperwork, a title search, and other expenses to obtain a mortgage.

While that number may seem significant at first glance, there are also plenty of ways to lower your closing costs. For example, just as there are down payment assistance programs, there are closing cost assistance programs.

You could also negotiate with the seller to include them in the total house cost. Although it is good to note that if there are multiple offers on a house, that could weaken your offer against other competitors. Also, doing so will increase your monthly payments over time because you will have borrowed more money to buy the house.

5. Your Monthly Mortgage Payments

Your monthly mortgage payment is a complex undertaking—and perhaps one of your most important financial transactions. Don’t let it be a blind spot.

You can use a mortgage calculator to figure out how much you will owe each month—for example, if you borrow $240,000 and finance it with a 30-year fixed-rate mortgage at 3 percent, that would amount to around $1,011 in monthly principal and interest.

When taking out a mortgage, you must consider that it won’t be your last payment. If you put less than 20% down, you’ll have to pay a mortgage insurance premium.

Mortgage insurance is a type of protection for the lender if you can ever no longer afford to make the payments on your home and are forced to sell it for below market value.

If you’re under 20% equity ownership, you’ll also need private mortgage insurance (PMI) until your equity reaches at least 20% of the property’s value.

Even though the price of PMI may vary depending on factors such as a borrower’s creditworthiness and income level, on average, they will pay approximately $30 more per month for this type of protection. We can help you!

6. Considering the Long-Term Costs of Property

Becoming a homeowner involves a lot more than just paying your mortgage. When thinking about how much money you need to buy a home, it’s crucial to consider a variety of long-term costs that are an integral part of owning a home. These recurring expenses are essential for realistic and sustainable financial planning.

Property Insurance and Taxes

Property insurance is one of the most important costs, essential to protect your investment against unforeseen events. Equally important are property taxes, which vary depending on location and home value. These expenses are not only mandatory but can increase over time, depending on local assessments and tax policies.

Homeowners Associations

If your property is part of a homeowners association, you will be subject to additional dues. These fees typically cover services such as maintenance of common areas, security, and, in some cases, certain utilities. Although they may represent an extra cost, they also add value by maintaining the quality and attractiveness of the neighborhood.

Regular Maintenance and Repairs

Additionally, as a homeowner, you will be responsible for the regular maintenance and repairs of your home. This includes everything from minor repairs to major renovations, as well as routine maintenance such as cleaning gutters, checking heating and air conditioning systems, and lawn care. These expenses vary, but it is wise to set aside a fund for contingencies.

Annual Fees and Budget Planning

Don’t forget that many of these expenses, especially taxes and insurance, are paid annually. It is vital that you include these amounts in your annual budget to avoid financial surprises. A good rule of thumb is to set aside a percentage of your annual income to cover these expenses proactively.

[Related Article: How to save for a house: The home savings tips you should know]

Are you planning to buy a house in 2024? Get started now and get a free call with us.

Buying a home is a significant step, and preparation is key. So, if you’re already debt-free and have an emergency fund, it’s time to do some math.

Ask yourself: How much do I need to buy a house? But always making sure that the monthly payment does not exceed 25% of your net salary.

At Real Estate Juan C, we know the importance of advance planning to acquire the home of your dreams. Therefore, we want to offer you a completely free call to guide you through this process. Click here to schedule your call and discover how we can help you adjust your home purchase to your budget.

[Related Article: 7 Things to Know Before Buying a House]

Do not wait anymore! Contact us today at Real Estate Juan C and take the first step towards your new home.

Let’s connect directly on WhatsApp.

This article was last updated on January 2, 2024.

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)

8 thoughts on “How Much Money Do You Need to Buy a House in 2024?”

Pingback: How Long Does it Take to Buy a House? - Real Estate Juan Cano

Pingback: 7 Things to Know Before Buying a House - Real Estate Juan Cano

Pingback: How to Buy a House in Massachusetts with Bad Credit - Real Estate Juan Cano

Pingback: Is it better to rent or buy a house? - Real Estate Juan Cano

Pingback: How to increase the mortgage pre-approval amount? - Real Estate Juan Cano

Whats up very cool website!! Guy .. Excellent ..

Wonderful .. I will bookmark your site and take the feeds also?

I am satisfied to find numerous useful information right here within the post, we need work

out extra techniques in this regard, thank you for sharing.

. . . . .

Pingback: 9 First-Time Home Buyer Mistakes - Real Estate Juan Cano

Nice information for a new blogger…it is really helpful!

Comments are closed.