Revamp Your Credit Score and Secure Your Dream Home: Unlock the Secrets to Buying a House with Bad Credit!

In the labyrinth of home-buying challenges, bad credit shouldn’t be a barricade between you and your dream home. Perfect credit is not a prerequisite for purchasing a property in Massachusetts, and with these five crucial tips, you can see how your credit improves!

While certain loans may bypass credit checks, they often come with inflated down payments and interest rates, making them far from enticing options. However, there’s a more empowering alternative – repairing your credit score.

No need to shell out thousands of dollars to a credit repair company. Armed with my expert advice and a dash of education, you can take matters into your own hands.

In as little as three months, your credit could become loan-worthy at any bank, provided you take the right steps and implement the right strategies.

Fixing bad credit is a simpler undertaking than you may think. Brace yourself for a crash course in quick tips that will magnify your credit score and fast-track your journey to owning a house in Massachusetts or any other state.

Prepare to exceed even your wildest homeownership expectations!

Let’s dive right in and destroy the obstacle of not being able to buy a house with bad credit.

This is how the bank looks at your credit score in general terms:

Excellent: 800 to 850

Very Good: 740 to 799

Good: 670 to 739

Fair: 580 to 669

Poor: 300 to 579

Remember that the Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%.

The bar is set relatively low to give everyone a shot at becoming a homeowner. So, buying a house with bad credit is still possible.

Now that you know you’re not as far as you thought, let’s understand how credit is established before buying a house with bad credit.

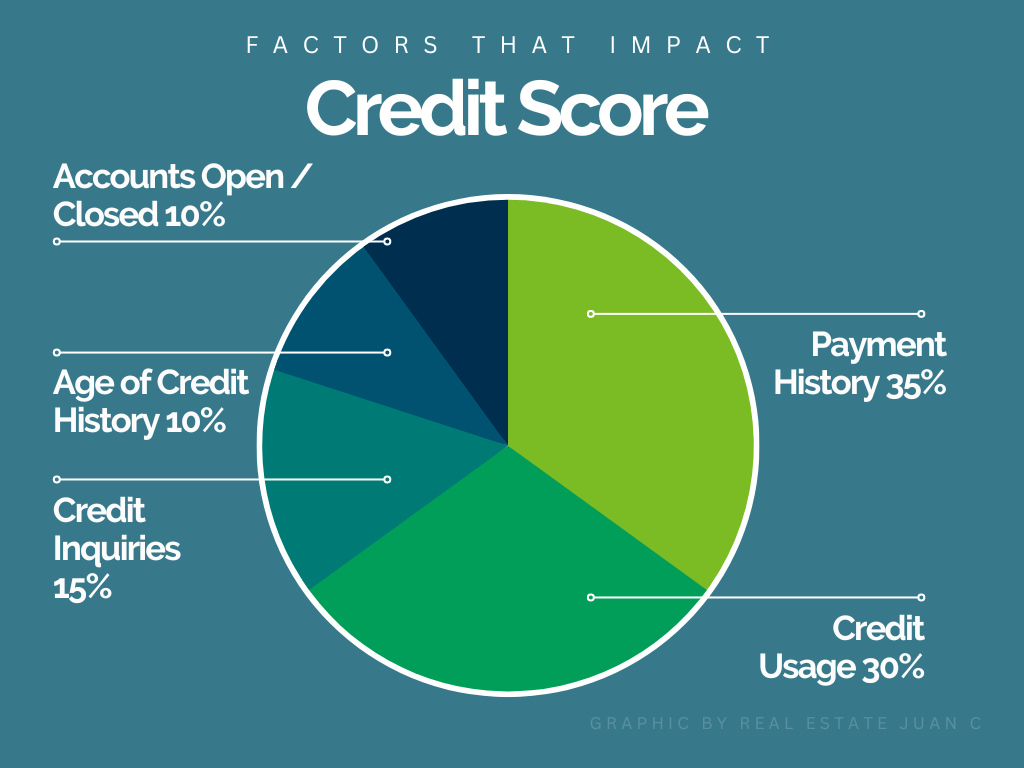

What affects your credit score?

Credit scores are determined by on-time payment history, credit usage percentage, credit age, number of hard inquiries, etc.

Nobody seems to know precisely how the mathematical formula to determine a credit score works.

Still, in general, this will guarantee you an excellent credit score and make you a trustworthy borrower in the eyes of the bank.

Keep these 5 things in mind for the following months, and watch your credit score fly through the roof if you’re wondering how to buy a house with bad credit.

1. Always pay on time!

Paying on time is probably the most crucial factor in building solid credit. For a borrower to trust you, they need to ensure that you have a good history of paying back debt.

When buying a house with bad credit, this is the first factor you should look at.

Pro tip: set a reminder on your phone to get a notification every month three days before your due dates. With this, you’ll be on top of your on-time payments!

2. Maintain your credit usage % low

Credit utilization refers to the amount of credit you are currently using compared to your total available credit.

A low percentage of debt compared to the amount of credit available to you will boost your credit score tremendously. I would say this is the factor where most people fail.

A quick rule of thumb is to keep your credit usage under 10%. The bank will interpret that as a risky financial move if you have a $1,000 credit card and owe $800 on it.

Also, the bank will be less likely to increase your balance in the future due to your high credit use of 80%.

A quick hack to decreasing your credit usage percentage is:

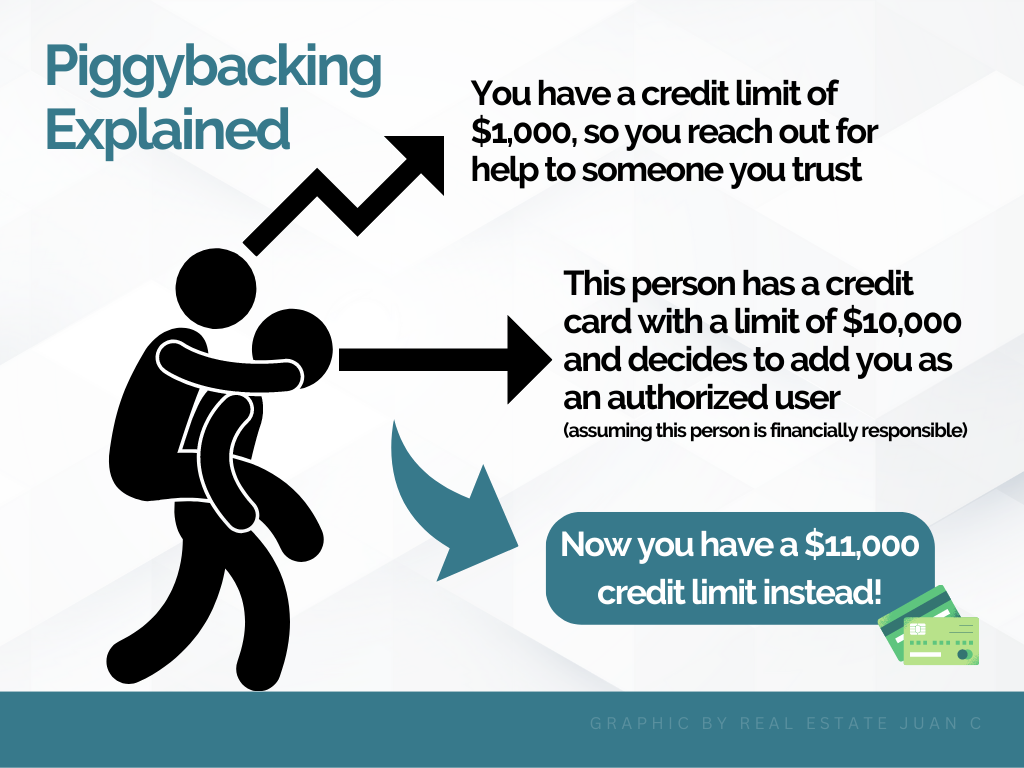

→ Piggybacking!

Reach out to a family member or close friend that has credit cards with a high limit and is very financially organized. Ask them to add you to one of their cards, but be sure to let them know you wouldn’t even have to carry the card with you and don’t intend to use it. This strategy is known as piggybacking if he or she can add you to their credit card.

Now let’s say that card you were added to has a limit of $10,000, and they owe $1,000. Therefore, now you have a credit limit of $11,000 (your card plus theirs), and your “debt” would be $1,800 (your debt plus theirs), bringing your credit usage percentage down to 16.4%.

Believe me, your credit will skyrocket!

One thing to be super careful with this strategy is that if they miss a payment, technically you did too, so make sure this person is trustworthy and responsible with their payments.

3. Have a high average credit age

Average credit age is the sum of the age of all your credit cards and loans divided by the number of accounts you have. The older your accounts, the better.

Instead of opening a new card, ask your current banks to increase your credit limit on your existing cards. This will increase your available credit and decrease your credit usage.

The bank often won’t even run your credit because they already feel comfortable dealing with you. On the other side, if you get a new credit card, they will check your credit 99% of the time.

4. Never close a credit card if you’re trying to buy a house with bad credit!

One common misconception that many people have is the belief that they should only keep the credit cards they actively use. However, it’s important to understand that closing a credit card can have several negative impacts on your overall credit profile.

Firstly, closing a credit card will result in a decrease in the total amount of credit available to you. This can have an adverse effect on your credit usage. Credit utilization is a significant factor in determining your credit score. When you close a credit card, it reduces your overall credit limit, which means that your credit usage can increase, potentially causing your credit score to decrease.

Secondly, closing an older credit card can significantly impact your average credit age, another crucial factor in credit scoring. The length of your credit history plays a role in determining your creditworthiness. If you were to close your oldest credit card, it would shorten the average age of your credit accounts. This sudden reduction in your credit history’s length could result in a significant drop in your credit score.

It’s essential to be mindful of these potential consequences before deciding to close a credit card. While it may seem like a logical step to streamline your finances, it’s crucial to weigh the potential negative impact on your credit standing.

Keeping older credit cards with positive payment histories can actually help boost your credit score over time.

5. Be careful with credit inquiries

The number of credit inquiries you have will also affect your score, so try not to pull your credit unnecessarily. Whenever a credit check is necessary, ask if you can bring in your credit check.

You can check your credit FOR FREE once every 12 months here.

If a credit check is necessary, make sure you ask them for a copy. Credit reports are valid for 120 days as determined by Fannie Mae guidelines, and many times, those scores will come in handy.

Let’s say you are looking to buy a house: you can go from lender to lender with your credit report within that time frame and see who can get you the best rate.

EXTRA: The last tip to boosting your credit and not worrying about buying a house with bad credit is:

– Checking your credit for unusual activity and disputes.

One of the most common cases is unauthorized credit checks. You have the right to dispute these with a simple form that must be submitted to the credit bureaus, letting them know you should not have that on your credit.

[Related Article: How Much Money Do You Need to Buy a House?]

In conclusion, you now hold the keys to unlocking your homeownership dreams, even with bad credit. You no longer need to rely on expensive credit repair companies. You’ve empowered yourself with the knowledge and tools to take control of your credit journey.

I hope we were able to answer how to buy a house with bad credit.

Remember, you’re not alone on this exciting path!

I’m Juan Cano, your local real estate agent in Revere, and I’m genuinely excited to be a part of your home-buying adventure. Let’s join forces and make your dream of owning a house in Massachusetts a reality.

Whether you’re searching for your dream home, need guidance through the complex home-buying process, or seek personalized financing options, I’ve got your back. My expertise and support are at your disposal, ensuring you have a trusted partner by your side every step of the way.

So, don’t hesitate to reach out and connect with me today. Let’s embark on this incredible journey together, turning your homeownership aspirations into cherished memories.

Your dream home is waiting, and I’m here to help you open its doors. Get in touch now, and let’s start making your dreams come true!

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)

10 thoughts on “How to Buy a House in Massachusetts with Bad Credit”

Pingback: How Much Money Do You Need to Buy a House? - Real Estate Juan Cano

Pingback: How to increase the mortgage pre-approval amount? - Juan Cano

I don’t even know how I ended up here, but I

thought this post was good. I do not know who you are but definitely you are going to a famous blogger if you aren’t already 😉 Cheers!

Wow, that’s what I was searching for, what a material!

existing here at this web site, thanks admin of this web page.

Great blog you’ve got here.. It’s hard to find good quality writing like

yours nowadays. I truly appreciate people like you! Take care!!

Everything is very open with a precise explanation about how to buy a house with bad credit.

It was really informative. Your site is extremely helpful.

Many thanks for sharing!

I just like the helpful information you provide to your articles.

I’ll bookmark your blog and take a look at again here regularly.

I’m reasonably certain I’ll be told many new stuff right right here!

Best of luck!

I do not even know how I ended up here, but I thought this

post was good. I don’t know who you are but definitely you are going to a famous blogger if you

aren’t already 😉 Cheers!

Pingback: 8 Steps on How to Buy a House - Real Estate Juan Cano

Pingback: Mortgage Application Process: Step by Step – Homebuyer Weekly

Comments are closed.