Can undocumented immigrants buy a house? This is probably one of the most common questions people in this situation ask.

With the continuing debate around immigration in the political sphere, legislation and state propositions about this may seem unpredictable. Foreign nationals or residents will have to deal with mountains of paperwork and navigate US residency requirements and visa restrictions.

However, you now also face mortgage loans, filing taxes abroad, and understanding how your credit here compares to that in your home country.

For example, if you want to purchase a home in the U.S., it matters what visa status you currently hold and if this permit is transferable or extended.

So, you are an immigrant, and you want to build your financial future in the United States. You’re so excited to buy a house but wonder if you can really do it.

In this article, we will clarify this big question for you and support you with the necessary information you need to navigate this process successfully:

Can undocumented immigrants buy a house?

Well, feel reassured because it is possible and a quick hint: the key lies in your taxes.

Continue reading to find all the info you need on buying a home in the US as an immigrant.

Buying real estate as an illegal immigrant

Buying a house in the United States can be simplified with the help of a mortgage, credit score, and down payment.

Still, those options require documenting your identity, which is hard for undocumented immigrants.

However, that does not mean they can’t buy a home.

Suppose you are an undocumented immigrant who has been given permission to live in the US and has worked here (legally) for two or more years without interruption or served in the military. In that case, you may qualify as an exception. These people can start owning homes by establishing a good credit history.

Many banks offer mortgages to undocumented immigrants through special programs like The Bank of American Immigration Program.

Other institutions like Wells Fargo have also started offering loans directly to folks who cannot prove their identity.

[Related Article: How Much Money Do You Need to Buy a House?]

How can undocumented immigrants buy a house?

There is often a myth that being a citizen of a country is a requirement to purchase property in that specific location. While some countries may have foreign ownership laws, no law in the United States prohibits non-citizens from owning homes.

This transaction may indeed involve some significant costs. This sometimes makes it difficult for undocumented immigrants to have the necessary resources. However, there is a hopeful solution: those who want to own a home can count on sponsors willing to finance their real estate projects.

Although securing a mortgage for undocumented immigrants can be challenging, alternatives are now available for those who want to own a home in the United States. Remember that this is regardless of your legal status.

It is possible to access home loans without having to prove citizenship!

Let us explain how undocumented immigrants can qualify for a mortgage and achieve their dream of homeownership.

Despite the obstacles immigrants face, owning a home is an achievable possibility. Here’s how to achieve it:

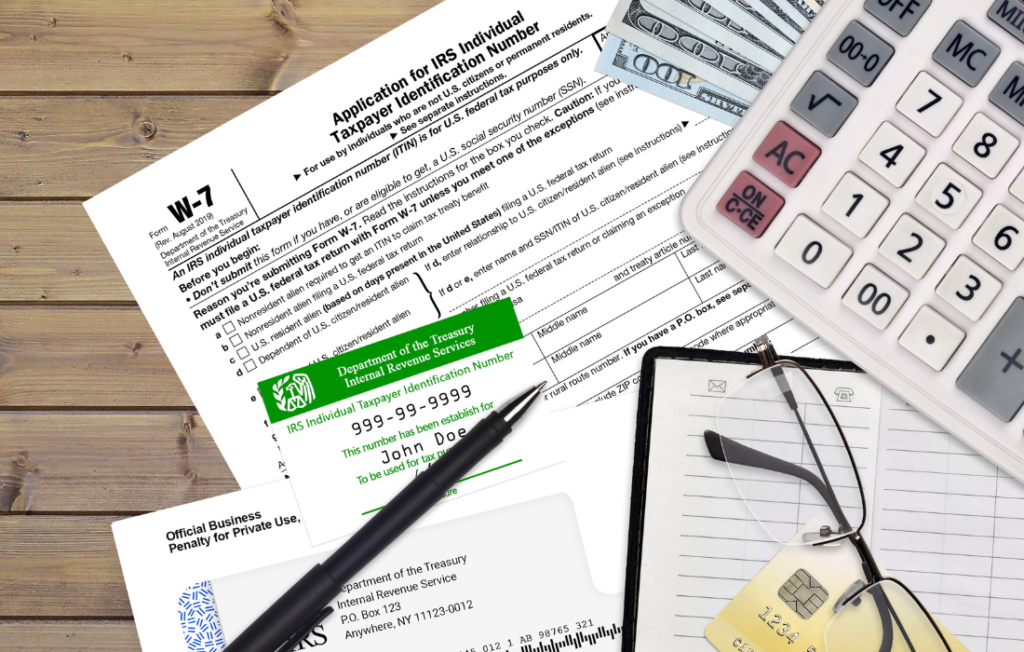

1. Obtain an ITIN

The best way undocumented immigrants can qualify for a mortgage loan is by using the ITIN mortgage. ITIN stands for Individual Tax Identification Number. It was created as an alternative to a Social Security Number so foreign investors could pay taxes on their assets in the United States.

Aside from acquiring an ITIN, undocumented immigrants can also open bank accounts, pay income taxes, and obtain a home loan.

One must complete a Form W-7, Application for IRS Individual Taxpayer Identification Number on the IRS website, and a Spanish version. Applicants will be required to provide their names, addresses, citizenship, and birth dates, among other things.

Within 40 days of completing it, you must mail it to the IRS Austin Center for ITIN operation with a completed tax return. The applicant will then receive their ITIN number.

2. Prepare the documentation for your down payment

Once you have an ITIN number, we suggest looking into ITIN loans. These loans can be found on company and bank websites across the US and can be granted by lenders willing to take extra steps to ensure that your ability to pay back the loan is legitimate.

Because of their higher risk level, it will be rare (though possible) for companies or banks to offer you a loan with less than 20 percent down. At a minimum, expect to pay 15%.

Side Note: New assistance program for ITIN holders has just been announced. This program makes it possible for the down payment to be 5% instead of 20%. Schedule a free meeting with me to learn more about it.

And just like any other loan application, some additional documentation may be required, which could include:

- Provide proof of income in the form of pay stubs from the last month.

- Provide evidence of consistent employment for the past two years.

- Submit tax returns for two consecutive years using the same ITIN.

3. ITIN Mortgage Application

The ITIN Mortgages are popular with undocumented, international home buyers and first-time entrepreneurs.

These mortgages carry an interest rate slightly higher than market rates. Still, because immigrants with irregular incomes often use them, ITIN mortgages are pretty common in many locations throughout the U.S. Banks and credit unions.

Banks and credit unions have varying policies on this type of mortgage. Therefore, one may choose to shop around for the best rates or decide to go with a smaller bank or a credit union that offers more competitive rates.

An excellent place to start looking for a mortgage might be with smaller, local banks or credit unions that offer lower interest rates than more giant corporations.

Some credit unions have specially designed loans for immigrants.

However, it is necessary that you either know someone who knows them personally or you have specific attributes to be eligible for their services.

There is a lot to consider when deciding which type of mortgage is best for you and your particular situation. Remember that we can help you.

If you are an immigrant from Massachusetts, schedule a free 15-minute appointment with me by clicking here.

Lastly, to conclude whether or not immigrants can buy a house in the US:

Homeownership can be highly beneficial in many ways. But how can undocumented immigrants buy a house?

Though it might look impossible, legal and financial obstacles need to be overcome, which could potentially make homeownership accessible to undocumented migrants in the future. One crucial way undocumented immigrants aid their nation is by contributing to the economy.

This means that if more could buy homes, they would purchase additional items and furniture. Still, they’d also likely pay income taxes and spend on property taxes, etcetera, perpetuating the cycle of wealth creation in the country!

[Related Article: How Long Does it Take to Buy a House?]

At Real Estate Juan C, we want to ensure you have all the necessary tools and information to find your dream house. If you live in Massachusetts, reach out to us today to start the process!

The article was last updated on 07/31/2023.

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)

3 thoughts on “Can Undocumented Immigrants Buy a House in Massachusetts?”

Thanks for sharing your info. I really appreciate your efforts and I will be waiting for your further write

ups thanks once again.

There is definitely a great deal to learn about this subject.

I really like all of the points you’ve made.

Pingback: Homepage

Comments are closed.