Purchasing a home is a significant milestone for individuals and families, but financial constraints often pose a challenge. Fortunately, multiple programs can help you. The United States Department of Agriculture (USDA) offers a loan program that provides a viable solution to aspiring homeowners in Massachusetts.

In this article, we will explore the eligibility requirements and benefits of USDA loans in Massachusetts, highlighting how this program can help individuals and families achieve their dream of owning a home.

Eligibility Requirements – Massachusetts:

The USDA loan program in Massachusetts provides an opportunity for low- to moderate-income homebuyers to secure affordable housing financing in designated rural and suburban areas.

Here are the key eligibility requirements for USDA loans in Massachusetts:

-

Income Limits:

The USDA considers the income of the entire household while determining eligibility. The total household income must not exceed 115% of the area’s median income for a family of one to four members. Larger households with five or more members may have slightly higher income limits.

-

Citizenship and Residency:

Applicants must be U.S. citizens or have legal permanent resident status. They must also demonstrate that they intend to use the property as their primary residence.

-

Credit History:

While a perfect credit score is not required, a medium score of 620 is needed. Applicants should have a reasonably good credit history. The USDA considers factors such as payment patterns, debt-to-income ratios, and credit utilization when evaluating creditworthiness.

-

Property Eligibility:

The property being purchased must be located in an eligible rural or suburban area as defined by the USDA. Prospective buyers can use the USDA’s online property eligibility map to determine whether a specific address qualifies for a USDA loan.

Check your property eligibility here.

Benefits of USDA Loans in Massachusetts:

-

No Down Payment:

One of the most significant advantages of USDA loans is that they require no down payment. This feature makes homeownership more accessible for individuals and families who may struggle to save a substantial amount for a down payment.

-

Competitive Interest Rates:

USDA loans in Massachusetts offer competitive interest rates, making them an attractive financing option. These rates are often lower than those offered by conventional loans, helping borrowers save money over the life of the loan.

-

Flexible Credit Requirements:

Compared to traditional mortgage loans, USDA loans are more flexible regarding credit requirements. This means that individuals with a limited credit history or a less-than-perfect credit score may still qualify for this program.

-

Lower Mortgage Insurance:

USDA loans have lower mortgage insurance premiums compared to other loan programs. This helps borrowers save money on monthly payments, further enhancing the affordability of homeownership.

-

Closing Cost Financing:

USDA loans allow borrowers to roll the closing costs into the loan amount. This feature can reduce the upfront expenses associated with purchasing a home and ease the financial burden during the home-buying process.

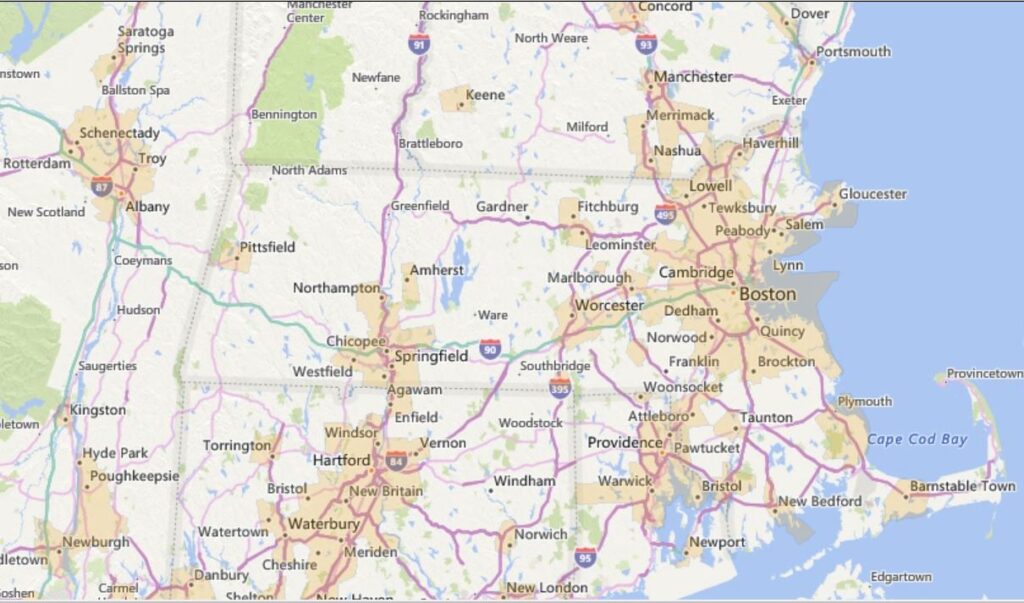

Check out this map with the towns that are eligible for a USDA loan (areas in yellow do not qualify):

[Related Article: Mortgage Application Process: Step by Step]

Conclusion,

For individuals and families in Massachusetts dreaming of homeownership, the USDA loan program provides an excellent opportunity to turn that dream into a reality.

With no down payment requirements, competitive interest rates, flexible credit requirements, and lower mortgage insurance, USDA loans make homeownership more affordable and accessible.

By meeting the eligibility requirements and choosing a property in an eligible area, aspiring homeowners can take advantage of this program and embark on their journey to owning a home in Massachusetts.

Reach out to us to find out about properties that are in the areas that qualify for the USDA loans in Massachusetts!

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)