Buying a house is an exciting process full of hopes and desires. It does, however, come with a fair share of financial considerations, particularly in relation to mortgage management.

It can be intimidating to think about interest rates and monthly payments, but what if there was a method to simplify and lower the cost of this process from the beginning?

This is where the idea of a mortgage buydown enters the picture and gives prospective homeowners hope. Imagine being able to reduce your mortgage payment each month in the future, putting your ideal home more comfortably within your reach.

You can get a lower interest rate on your mortgage by paying a bit more ahead, which will change how you view your house loan and your financial future.

A mortgage buydown is a calculated step toward reaching your homeownership goals more quickly and with less financial burden. It’s more than a financial term; I want to help you understand it.

In this article, I will clarify the idea by demonstrating the various forms of buydowns, how they operate, and how they could fit into your home-buying strategy. So continue reading if you’re interested in learning how to make the process of becoming a homeowner easier to handle and less expensive.

You may have discovered the secret to getting a less expensive mortgage and a better financial future.

Table of Contents

ToggleWhat Exactly Is A Mortgage Buydown?

A buydown allows a borrower to pay discount points at closing in exchange for a lower interest rate.

Discount points, which are one-time fees paid in advance, are also known as mortgage points or prepaid interest points. For the duration of the loan, the interest rate is lower when discount points are applied.

In a different kind of buydown, the interest rate is initially lowered for a predetermined period of time when points are purchased.

The money escrowed by the seller is usually used to pay for this arrangement. The borrower’s monthly mortgage payments are more manageable at this period because the interest rate is lower.

A mortgage buydown can be a wise move in times of rising interest rates since it provides a means of securing reduced monthly payments. However, its appeal may diminish in a market where rates are predicted to decline. Under these circumstances, refinancing becomes a better option because it can result in more significant savings without the buydown’s upfront costs.

How Much Does It Cost To Buy Down An Interest Rate?

The cost of buying down (or lowering) an interest rate is based on the loan amount. A discount point is equivalent to 1% of the loan amount per point. And your interest rate is lowered by 0.25% for every point you buy.

For example, if your loan is $500,000, one percent would be $5,000. Therefore, one point would cost you $5,000.

Assuming the interest rate is 5% when you buy that point, it can reduce your interest rate by 0.25%, being the new interest rate of 4.75%.

However, your credit score might influence how much a point can lower your rate, requiring more points to achieve a whole percent decrease.

Remember, this is a simplified example and not professional advice. Always consult a financial advisor for guidance tailored to your situation.

Who Is Eligible For A Mortgage Buydown?

The person who benefits from a buydown is usually the buyer (or borrower); however, this isn’t always the case. Sellers and builders are also known to buy points to lower the buyer’s interest rate.

Each party has strategic reasons for participating in buydowns, aiming to balance immediate costs with long-term benefits. Let’s explore each of them.

Buyers

Buyers often work with lenders to lower their future interest rates by paying upfront. This strategy can make their long-term mortgage payments more manageable, especially when planning to stay home for many years.

- Typically negotiate buydowns with lenders.

- Pay points upfront for a lower interest rate.

- Benefit through more affordable mortgage payments.

Sellers

Sellers might buy down the mortgage rate to make their property more appealing. This can speed up the sale process and fetch a higher sale price, despite the initial cost.

- May offer to buy down the mortgage as an incentive.

- Can add the cost to the home’s sale price.

- Helps make the property more attractive to potential buyers.

Builders

Builders use buydowns as a promotional tool to attract buyers to new developments. Offering lower interest rates upfront can entice people to commit to a purchase before a community is fully established.

- Often pay points to attract early buyers.

- Use buydowns as incentives in new communities.

- Less likely to offer once the community is established.

Understanding the Mortgage Buydown Structure

Buydowns can be set up in a number of ways since they are negotiated. Lenders frequently employ the 1-0 and 2-1 buydown structures in addition to buydowns during the loan term. 3-2-1 buydowns are less frequent.

At closing, the buyer, seller, or builder will pay points to the lender, which make up the difference between the standard interest rate and the decreased rate. The buyer will benefit from the lower interest rate until the buydown expires, often a few years later.

But it is essential to mention that buydowns don’t always expire.

If they expire, the buyer’s monthly mortgage payments would go up. This is because they will have to pay the standard interest rate for the balance of their mortgage term.

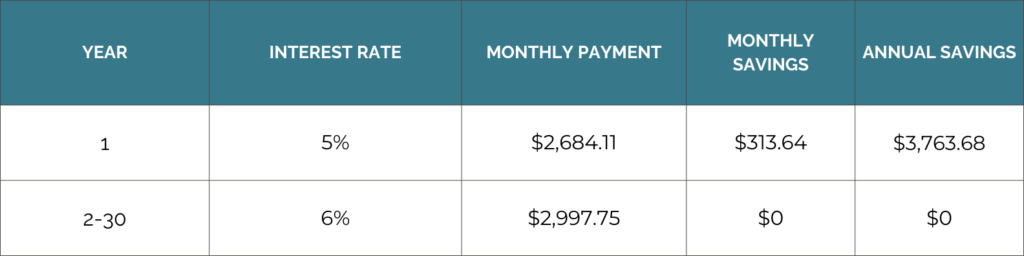

Buydown of 1-0

Your interest rate is 1% less with a temporary 1-0 buydown than it would be for the remaining balance of the loan during the first year of the agreement.

This reduces your interest rate only for the first year, and the following years have the original interest rate.

Check this breakdown for a 30-year fixed loan amount of $500,000 at a 6% interest contract rate.

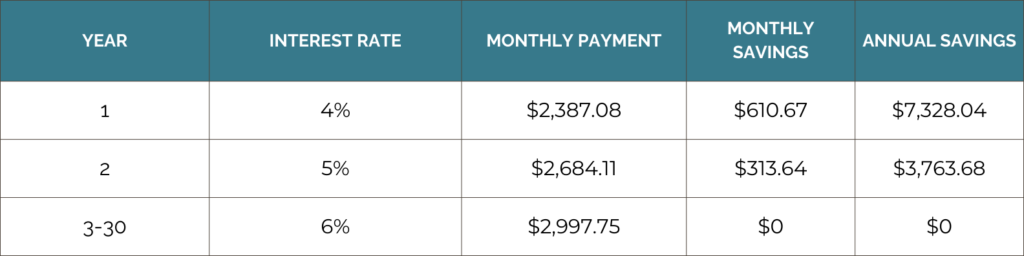

Buydowns of 2-1

A buyer can likewise benefit from a discounted interest rate with a 2-1 buydown, but only for the first two years of the loan’s life.

The interest rate would be 2% lower in the first year and 1% lower in the second year. After that, the interest rate will be the original one.

Check this example for a 30-year fixed loan amount of $500,000 at a 4% interest rate in the first year, 5% interest in the second year, and 6% for the remaining years.

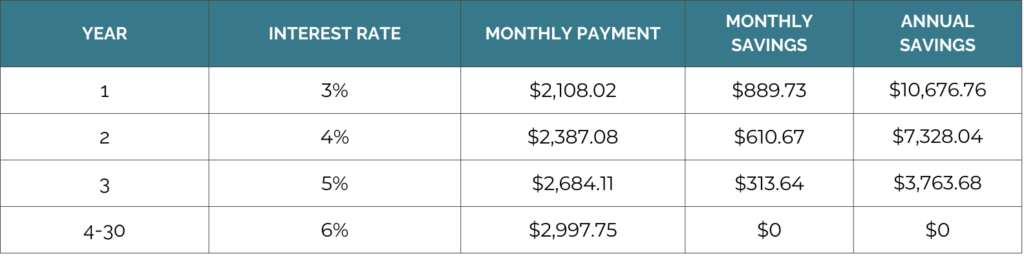

Buydowns of 3-2-1

A 3-2-1 buydown allows a buyer to receive a 3-year loan with lower interest rates on their mortgage. The interest rate is lowered by 1% for the first three years thanks to the upfront points payments.

Assume a buyer meets the requirements for a 30-year fully amortized mortgage with a 6% interest rate and wants to borrow $500,000. The buyer chooses to use a 3-2-1 buydown to reduce their interest rate for the first three years.

In this case, the buyer would have to pay three percent less in the first year, two percent less in the second year, and one percent less in the third year. However, they are responsible for the original 6% interest rate after the third year.

Check this example for a 30-year fixed loan amount of $500,000 at a 3% interest rate in the first year, 4% interest in the second year, 5% interest in the third year, and 6% for the remaining years.

There is another alternative, which is to distribute the interest rate equally across the years. Let’s explore that scenario.

Reductions in Interest Rates Distributed Equally

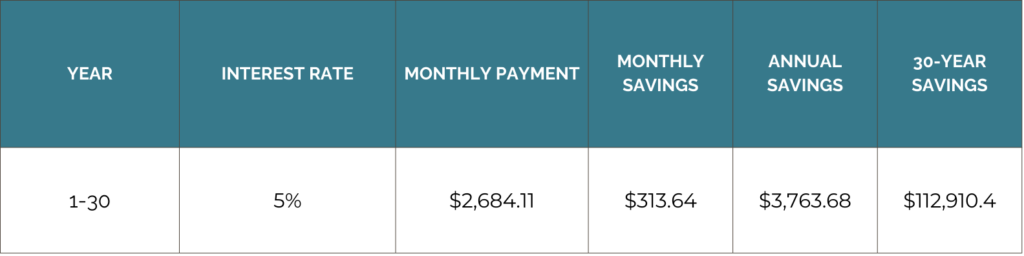

In some instances, a buyer might buy enough discount points to lower their interest rate on the loan gradually. Through a buydown loan, the buyer can avoid an increase in interest rates and, consequently, monthly mortgage payments by making an even greater upfront payment.

Applying the identical example from before, the buyer would be responsible for a $2,997.75 monthly mortgage payment on a zero-point loan—a loan for which no discount points are applied. The buyer’s payments would be as follows if they choose to pay 5% interest throughout the course of the loan and buy down the mortgage:

The total cost of the buydown would be higher since the buyer would be reducing their interest payments throughout the duration of the loan, as opposed to just two or three years.

These buydowns typically cost between $18,000 and $25,000 (saving buyers approximately $100,000 during the 30-year term), but they are only worthwhile for those who plan to remain in the house for more than five years or longer.

Remember that your savings throughout the first few years of the loan will mostly depend on the kind of mortgage for which you are qualified. Every kind has a unique mortgage rate, which will immediately impact your monthly payment and, eventually, your monthly and annual savings.

Also, these examples assume there is a 0 down payment. If you wish to calculate it more accurately based on your specific situation, I invite you to use our mortgage calculator.

How to know if you should buy down your mortgage rate?

There are a few things to consider when deciding if a buydown is the right move for you.

First, it is important to note that really the best buydowns occur when a builder or seller agrees to pay the discount points on the buyer’s behalf without raising the home’s purchase price. This is a possible scenario and the one that will benefit the buyer the most.

However, if the buyer plans to pay the points themselves, it’s important to consider the following circumstances:

- A buydown is especially suited for long-term homeowners.

- Buydowns are advantageous in rising interest rate scenarios, offering lower payments early on.

- In environments where interest rates are expected to decrease, refinancing might be a more cost-effective alternative compared to buydowns. This way, buyers could avoid upfront costs while still capitalizing on potential savings.

Always seek personalized advice from a financial advisor to navigate these decisions effectively.

Determine the profitability of a mortgage buydown for your specific situation

If you want to determine if buying down your interest rate is worth it, you must do some calculations. You should get the breakeven point, which is the amount of time it would take you to recover the amount you spent to buy the points that lowered your interest rate.

To look for that, divide how much you paid for the points by how much you’ll be saving monthly. Let’s check an example together:

Imagine you get a $500,000 loan for your house at 6% interest. Reducing the rate to 5% would cost you around $20,000 (4 points). With this reduction, your monthly payments go from $2,997.75 to $2,684.11, saving you $313.64 monthly.

If you take the $20,000 and divide it by $313.64, it gives you 63.76. This means that 63 months would be your breakeven point. It would take around 5 years and 3 months to get back the money you spent buying the points.

A buydown won’t make sense for you as the buyer if you believe there’s a chance you’ll sell the house or refinance before the 63-month period. Instead, consider making additional payments because paying off your mortgage early might also result in interest savings.

Are there any restrictions with buydowns?

Yes, it is important to know that there are certain restrictions, so you should speak with a lender if you’re interested in a mortgage buydown.

Certain restrictions include:

- Real estate deals involving investment properties or cash-out refinances. Nevertheless, as long as the government does not support the refinance, you can purchase points.

- State-specific regulations.

- Programs that get funding from the federal government are likewise subject to limits. For instance, only fixed-rate mortgages used to buy homes are eligible for temporary buydowns with FHA loans.

Conclusion

Mortgage buydowns can be a strategic way to lower monthly mortgage payments, offering potential long-term savings through upfront payment of discount points.

However, they’re not universally ideal, depending on interest rate trends, personal financial circumstances, and the expected duration of home ownership.

Calculating the breakeven point is crucial to understand if the initial investment pays off over time.

This article intends to inform readers on mortgage buydowns rather than provide financial advice. We can put you in touch with experts if you’d like to learn more about this option or would like professional advice.

On the other side, if you’re thinking about buying a house in Massachusetts, we can help you find your ideal property based on your requirements and budget!

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)