Can you imagine opening the door to your own home before turning 30 and feeling that you’ve achieved one of the most important milestones in your life? It may sound like a distant dream, but it’s absolutely possible—and I’d love to show you how.

In this guide, you’ll discover step by step how to buy your first property before the age of 30, with practical tips on saving, credit, and financing that will help make that dream a reality.

From our experience in the real estate market, we know that buying a property before 30 is not only possible, but completely achievable!

We’ll guide you step by step through the home-buying process, from technical details to practical advice, giving you the knowledge and motivation you need to take your first big step toward property ownership.

Now get ready, because I’m about to walk you through the step-by-step process of buying your first home BEFORE you turn 30… Keep reading!

Step by Step: How to Buy Your First Home Before 30

Step 1: Achieve Job Security and Financial Stability

On the journey to buying your first property, the first crucial step is ensuring job security and financial stability. Why is this so important? Because during the home-buying process, mortgage lenders will require the last two years of your tax returns. These documents are crucial as they demonstrate your income and your ability to pay the mortgage on your new home.

If your income isn’t backed by a stable, documented work history, the path to homeownership can become much more difficult.

That’s why it’s essential to secure job stability before starting the home-buying process. This means maintaining steady employment for at least the last two years, with consistent, documented income. Lenders look for evidence of stability and the ability to maintain a job that guarantees a steady flow of income, giving them confidence that you’ll meet your financial obligations over time.

How can you achieve this? Stay focused on your career, seek opportunities for professional growth, and make sure to keep a solid record of your income over the years. While it requires effort and dedication, job security and financial stability are key to opening the doors to homeownership and achieving your goal of owning a home.

Step 2: Maintain a Strong Credit Score

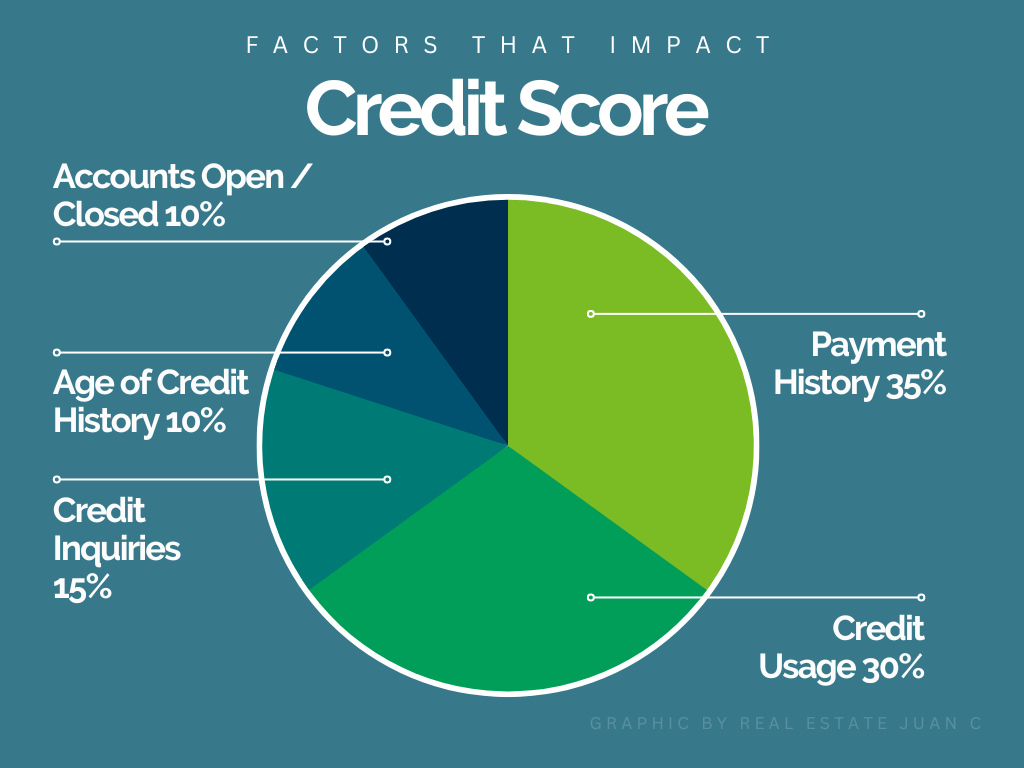

Mortgage lenders will carefully review your credit history to assess your ability to manage debt responsibly.

Imagine this: you’re in the final stage of your home-buying process, about to get your mortgage approved—but do your financial habits back you up? If your credit history shows irresponsible debt or late payments, you could face challenges securing financing for your new home.

That’s why it’s critical to maintain a strong credit score.

Avoid unnecessary debt and use your credit cards responsibly. This means paying your bills on time, keeping low balances, and avoiding impulsively opening new lines of credit.

Remember, your credit score is like your financial résumé. It reflects your payment history, debt levels, and credit management, and lenders will use it to determine your reliability as a borrower. A strong credit score can unlock better interest rates and more favorable loan terms, while a poor score can limit your options and increase borrowing costs.

So, how can you maintain a strong credit score? The key is financial responsibility and discipline. Pay your bills on time, keep your credit utilization low, and review your credit report regularly to detect and correct any errors.

If you have poor credit, you may want to check out this blog: How to Buy a House with Bad Credit.

Step 3: Build Your Savings

Although there are many programs designed to help first-time buyers, including options that allow you to purchase a home with 0% down, it’s still essential to have strong savings to make the most of all available opportunities.

So, how much should you save for your first property? While the answer may vary depending on your personal situation and market conditions, it’s generally recommended to save at least 5% of the property’s value as a down payment. This allows you to qualify for a variety of loan programs, including FHA and conventional loans, as well as other programs specifically for first-time buyers.

Want to learn more? Check out this post: FHA Loan vs. Conventional: Which Is the Better Option?

Savings provide the financial security and stability needed to face challenges and seize opportunities during the home-buying process. They also give you more confidence in negotiations, help cover closing costs, and ultimately get you closer to achieving your goal of homeownership.

How can you build your savings? The key is financial planning and discipline. Set realistic savings goals, reduce unnecessary expenses, and look for ways to increase your income. Automate your savings by setting up automatic transfers to a dedicated savings account, and consider maximizing returns through interest-generating financial tools.

You may also find this useful: How to Save for a House: Tips You Need to Know.

Step 4: Keep Your Options Open

Finally, take a broad and strategic perspective when searching for your first property before turning 30. At this stage in life, responsibilities may be fewer, giving you the chance to explore different options and make smart financial decisions for the future.

Look across multiple areas where you can find promising real estate investment opportunities. What should you consider when choosing a location for your first property? Here are some key factors:

-

Population Growth: Areas with consistent growth often lead to increased housing demand, boosting long-term property values.

-

School Quality: Good schools not only indicate a thriving community but can also increase property values. Young families often look for homes near quality schools, maintaining demand in those neighborhoods.

-

Property Appreciation: Research the property value trends in the area over recent years. Steady appreciation often signals a healthy and growing real estate market.

-

Multifamily Properties: Consider investing in duplexes or triplexes. These properties allow you to generate additional income by renting out extra units.

-

Rental Income: Another option is renting out rooms in your home. This can cover part—or even all—of your mortgage, easing financial pressure and improving cash flow.

What You Need to Know Before Buying in 2025

Buying your first property isn’t just about finding a nice-looking house; it’s also about understanding the market conditions and current financing rules.

In 2025, banks and lenders have adjusted their requirements, so being prepared will make all the difference.

-

Recommended Mortgage Payment

Experts suggest keeping your mortgage payment at or below 35% of your net monthly income. This ensures you still have room for living expenses, savings, and emergencies without risking financial stability. -

Look Beyond Appearances

Before signing, always check the property’s physical condition—electrical systems, plumbing, foundation, heating, and insulation. -

Consider Multifamily Properties as a Strategy

If your goal is to generate income while building wealth, a multifamily home or property with rental units can be the best choice. Living in one unit and renting the others can cover most—or even all—of your mortgage, accelerating your path to financial independence. (This is exactly how I personally built wealth through real estate.) -

Learn About First-Time Buyer Incentives

Some states and banks offer assistance programs for first-time buyers, such as lower down payments (3.5% or 5% instead of 20%), preferential rates, or tax credits. Exploring these opportunities can make a huge difference in your buying power. -

Get Advice from Experts

Always remember the importance of seeking expert advice. Just as doctors take care of your health and mechanics take care of your cars, real estate agents and investors help you find the right properties and guide you through the process in the best possible way.

Conclusion

Throughout this blog, we’ve explored the key steps and smart strategies to help you reach this important milestone in your life.

In summary, buying your first property before 30 can be an exciting step toward financial independence and stability. With proper planning, financial discipline, and an open mindset, you’ll be one step closer to becoming a homeowner and opening the door to your future.

Remember, you’re not alone on this exciting journey.

I’m Juan Cano, your real estate agent and investor in Revere, MA, and my mission goes beyond helping you find a beautiful home. I want to guide you in making smart decisions that build long-term wealth.

I firmly believe that your first house is rarely your “dream home,” but it can be the property that opens the doors to the world of real estate investing. That first purchase is the beginning of a journey toward stability and financial freedom.

Whether you need guidance through the buying process, strategies for investing in your first property, or clarity on the best financing options, I’m here to help.

Get in touch today and let’s start planning your financial future with real estate.

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)