This housing slump, which has seen price drops for 11 straight months, is currently affecting the real estate industry, which has been the driving force behind China’s fast expansion since the financial crisis of 2008.

Hundreds of thousands of Chinese homeowners have threatened to stop paying their mortgages until they resume construction (In China, developers frequently sell the homes before they finish building them).

These boycotts might have an impact on $222 billion in bank-held loans, or 4% of the nation’s outstanding mortgage balances, according to the analysis from ANZ Research.

China Real Estate Crash: A Bubble That Could Burst

BEIJING — According to Moody’s, China’s real estate industry generates more than a quarter of the nation’s GDP. Therefore, a China real estate crash can have a considerable impact.

According to The Times reports, Chinese homebuilders have had problems paying their contractors, and several development projects have been postponed or halted.

In desperation and protest, many groups refuse to continue paying their mortgage payments while construction work stalls. However, according to a report from Fitch, the recent increase in purchasers delaying mortgage payments due to delayed projects highlights the potential for China’s real estate crisis to worsen.

If China’s real estate issues don’t improve, they might spread to other vital industries. According to rating agency Fitch, three specific sectors are most at risk during this China Real Estate Crash.

1. Asset management companies

These companies are “particularly susceptible to extended property-market crisis” because they “keep a sizable quantity of assets that are secured by real estate-related collateral,” based on the report.

2. Engineering and construction firms (non-state-owned)

According to the report, “the industry has been experiencing difficulties since 2021. They do not have competitive advantages in infrastructure project exposure or finance availability relative to their counterparts connected to the state.”

3. Smaller steel producers

According to the report, many “have been operating at a loss for a few months and might face liquidity concerns.”

Construction, according to Fitch, accounts for 55% of China’s steel consumption.

Broader economic indicators like fixed asset investment and the retail sales segment that includes furniture have already been negatively impacted by the downturn in real estate.

According to official data, residential property sales decreased 32% in the first half of this year compared to the same period last year, Fitch noted.

What the China Real Estate Crash means…

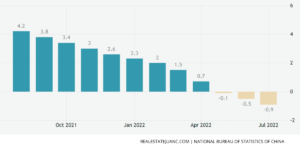

Following a 0.5 percent dip in June 2022, the average new house price in China’s 70 largest cities decreased by 0.9 percent annually in July 2022. During COVID-19 outbreaks in several areas and a slump in the real estate market, new house prices fell for the third consecutive month, falling by the largest amount since September 2015.

As the mortgage crisis worsens, housing values continue to decline.

“Fitch believes the recent increase in homebuyers delaying mortgage payments due to delayed projects underlines the potential for China’s property crisis to worsen. The declining confidence could stall the sector’s recovery, which will eventually have an impact on the domestic economy,” the report states.

The second-largest economy in the world has been suffering from a property downturn for nearly a year. However, Chinese officials have been stepping up their attempts to stop it. These include encouraging banks to lend more, lowering the cost of mortgages, and loosening some ownership regulations.

Check out more real estate content.

Stay up to date with the latest real estate news by subscribing to our newsletter below!

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)