The cost of living in Boston is skyrocketing, and it doesn’t look like it’s going to slow down anytime soon. Inflation is driving the prices of everything from groceries to gas, and rent is no exception.

The average rent prices in Boston have been steadily increasing for the past few years, and this trend looks set to continue. The median rent in Boston is now $3,772.

By the numbers: Among the thousands of Boston-area listings posted through Dwellsy, housing rental prices increased 9.7% from August 2022 to October 2022, the report shows.

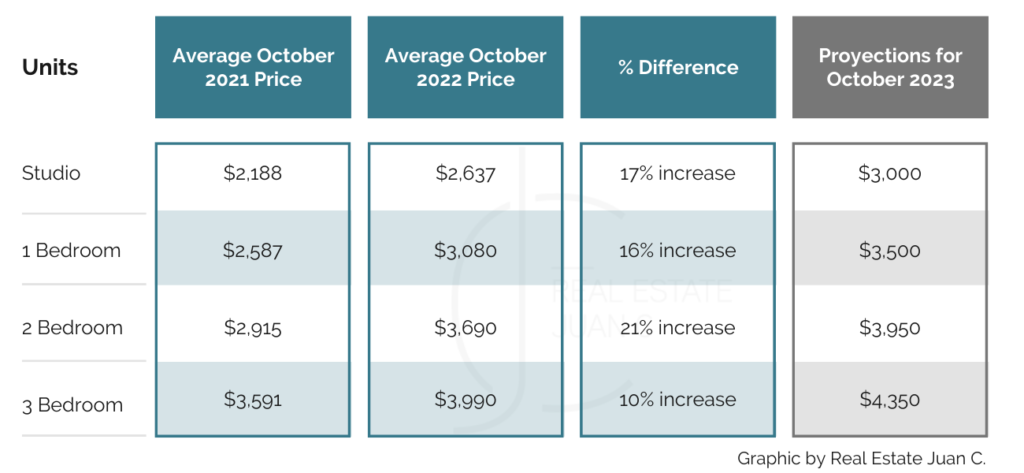

According to RENTCafé research, the Boston average rent is as follows.

Boston Average Rent:

- The average rent for a studio apartment in Boston is currently $2,637. This shows a 17% increase compared to the studio rent average in 2021. Projections estimate an increase from $2,637 to at least $3,000 next year on average.

- The average rent for a one-bedroom apartment in Boston is currently $3,080. This is a 16% increase compared to the previous year. Projections estimate an increase from $3,080 to at least $3,500 next year on average.

- The average rent for a two-bedroom apartment in Boston is currently $3,690. This is a 21% increase compared to the same date in 2021. Projections estimate an increase from $3,690 to at least $3,950 next year on average.

- The average rent for a three-bedroom apartment in Boston is currently $3,990. This is a 10% increase compared to the same date in 2021. Projections estimate an increase from $3,990 to at least $4,350 next year on average.

Take a look at the Boston average rent prices in 2021 compared to 2022 and the projections for 2023:

Boston’s average rent increase is bad news for renters/tenants, as it shows that their rent payments will only continue to rise. This is also likely to cause an increase in the number of evictions as landlords try to recoup their losses.

In addition, this will put pressure on the already-stretched housing market in Boston as more people look to rent rather than buy. All of this is likely to cause even more problems for the city’s residents, who are already struggling to keep up with the high cost of living.

However, as Boston’s rental prices continue to rise, many Bostonians are starting to feel priced out of the city. But as rent costs continue to rise, more and more people are beginning to explore the idea of buying a home. No surprises there!

The housing market is continuously changing. The increase is not only for the rent prices; mortgages are also increasing. However, the difference between the two is that while renting, you’ll have less money over time. But by having a mortgage, you’ll have something that is yours that is constantly increasing its value.

The average monthly mortgage price on a $500,000 single-family property in the outskirt of Boston in October of 2022 is $3,500. In many cases, this price is lower than monthly rent prices. But even if it isn’t lower, you could be owning your own home for only a couple hundred more.

For years, renting was the only option for many people. But as the cost of renting continues to rise, buying a home is becoming a more attractive option and a much better investment for more and more Bostonians.

If you are considering buying an investment property or multi-family home to live in one unit and rent the others, I can help you. The increase in rent will translate into a higher return on investment on those properties.

Side note: many government assistance programs currently offer between 5 and 15% of the property value to buy a house.

If you want to learn about those programs and explore the option of investing in real estate, schedule a free consultation here.

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)