Making the decision to buy a home is one of the most important moments in many people’s lives. With the real estate market constantly changing, it’s natural to wonder whether it’s better to buy a home now or wait until conditions “improve.” The key lies in understanding how the market works so you can leverage it to your advantage, and in this blog we’ll explain it in detail.

Imagine you’re in the following situation: you’ve been diligently saving for the down payment on your home and you finally have the funds ready. You’ve found a couple of neighborhoods you like and you’re excited to take the next step. However, you hesitate because you’ve heard that mortgage interest rates are higher than they were a few years ago, and you ask yourself: Should I wait until rates go down to get a better deal?

This is a valid question many homebuyers ask. But now ask yourself: what if home prices go up while you wait? And if, by the time rates finally drop, prices have risen so much that the savings on interest don’t really make a difference?

The dilemma of buying now or waiting is complicated—but it doesn’t have to be. In this blog, we’ll help you understand why it can be more advantageous to buy now and then refinance later when interest rates go down. By the end of this blog, you’ll have a clear understanding of market dynamics and be better prepared to make an informed decision about buying your home. Whether you decide to buy now or wait, knowledge is power, and we’ll give you the tools you need to make the best choice for your personal and financial situation. Let’s dive in!

The Dynamics of the Real Estate Market

The real estate market is influenced by various factors, with interest rates and home prices being two of the most important. These elements not only affect the decision to buy a house, but also when the best time to do it might be. Below, we’ll explain how these factors interact and why buying now can be a smart strategy.

Relationship Between Interest Rates and Home Prices

Interest Rates and Affordability

Mortgage interest rates directly affect the cost of financing a home. When interest rates are high, monthly mortgage payments increase, which can reduce affordability for many buyers. For example, if you want to buy a $600,000 home with a 30-year mortgage, the difference in the monthly payment between a 3% interest rate and a 5% interest rate can be significant. At 3%, your monthly payment would be about $2,530, while at 5%, it would rise to around $3,220. This $690 monthly difference can be a major obstacle for many buyers. On the other hand, when interest rates are low, monthly payments decrease, making homes more affordable. This can increase housing demand, as more people are able to buy. It’s common for an increase in demand to drive up home prices, as buyers compete for a limited number of available properties.

Home Prices

Home prices are directly related to interest rates. When rates are low, more people look to buy, which drives demand higher. This increased demand tends to push home prices up. Imagine a popular neighborhood where interest rates have recently dropped. Suddenly, many families who couldn’t afford to buy there before now find mortgages more accessible and start making offers on the same homes. Sellers who previously had to choose between a couple of offers now face multiple bids. And who do you think wins? Probably the highest offer. The more demand, the higher the property prices go. Conversely, when rates are high, housing demand can decrease, as fewer people can handle the higher monthly payments. This can lead to “stabilization” or even a decline in home prices, as sellers adjust their expectations to attract buyers.

Future Market Projections

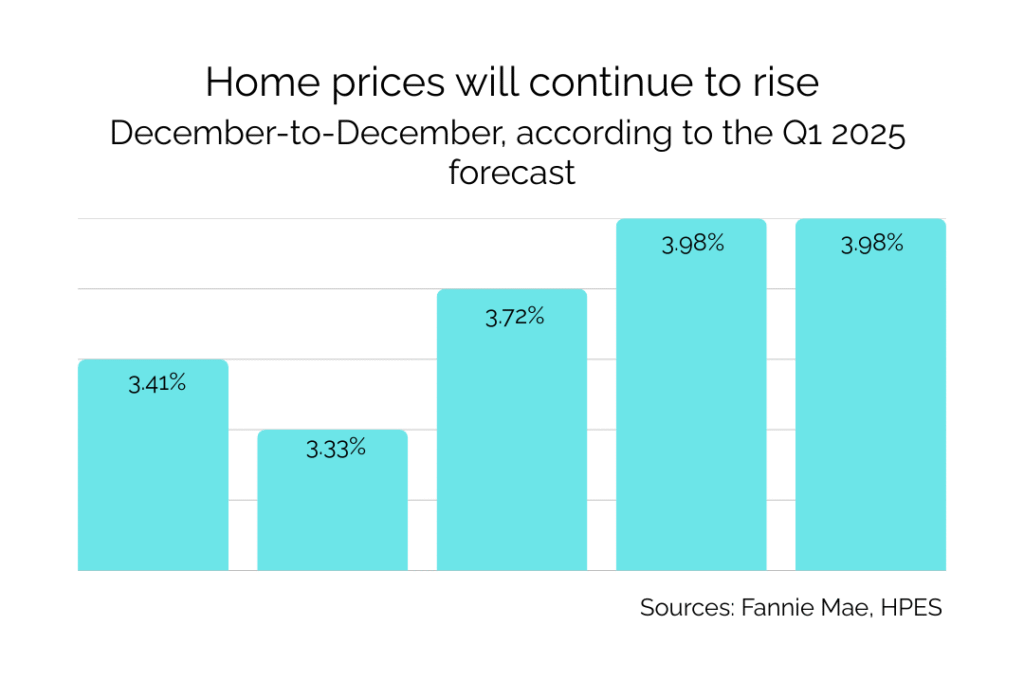

Rising Prices

In many markets, home prices tend to rise over time due to property value appreciation and economic growth. If you wait too long to buy, you may face higher prices in the future. For example, if a house costs $600,000 today and the annual appreciation rate in your area is 3%, in five years that same house could cost around $694,000. Buying now allows you to lock in a property at today’s prices and benefit from long-term home value appreciation.

Interest Rate Variability

Interest rates can fluctuate due to economic policies and market conditions.

Although current rates may seem high, there is no guarantee that they will drop significantly in the short term. Central bank decisions, inflation, and other global economic factors can influence interest rates.

For example, if the central bank decides to raise rates to fight inflation, mortgage rates could climb even higher, making monthly payments even more expensive.

The possibility of rates decreasing in the future is one of the reasons why buying a home now can be beneficial. If you buy now, you can take advantage of today’s home prices and, when rates drop, you can refinance your mortgage to lower your monthly payments. This allows you to benefit from property appreciation while keeping long-term financing costs under control.

Interest Rate Variability

Interest rates can fluctuate due to economic policies and market conditions.

Although current rates may seem high, there is no guarantee that they will drop significantly in the short term. Central bank decisions, inflation, and other global economic factors can influence interest rates.

For example, if the central bank decides to raise rates to fight inflation, mortgage rates could climb even higher, making monthly payments even more expensive.

The possibility of rates decreasing in the future is one of the reasons why buying a home now can be beneficial. If you buy now, you can take advantage of today’s home prices and, when rates drop, you can refinance your mortgage to lower your monthly payments. This allows you to benefit from property appreciation while keeping long-term financing costs under control.

Advantages of Buying Now

Buying a home now, despite current interest rates, can offer several advantages that are often overlooked. Let’s look at some of the reasons why this can be a smart strategy:

Access to Available Properties

Less Competition

In a higher interest rate environment, buyer competition can be lower. This means you may have more options and face fewer bidding wars. Imagine you’re interested in a home in a highly sought-after neighborhood.

In a low-rate market, it’s likely there would be multiple competitive offers for that same house, driving the final price higher. In contrast, with higher rates, there are fewer buyers competing, which can give you an advantage.

You may be able to negotiate the purchase price and sales terms with more ease, increasing your chances of getting the home you want without entering a bidding war.

Opportunities in Inventory

With fewer active buyers in the market, you might find more properties available. This gives you more negotiation power in terms of price and conditions.

For example, you may come across sellers who are more willing to offer incentives, such as helping with closing costs or making repairs, to attract the limited pool of buyers. In addition, in a less competitive market, you can take the necessary time to evaluate several options and choose the one that best fits your needs and budget.

Building Equity

Increase in Property Value

By buying now, you start building equity right away. As you pay down your mortgage and your property value increases, your net worth also grows. Suppose you buy a home for $600,000. If the market’s annual appreciation rate is 3%, in five years your home’s value could rise by nearly $100,000. During that time, you will also have reduced the principal on your mortgage, further increasing your equity.

Long-Term Benefits

In the long run, home value appreciation can outweigh the additional costs associated with higher interest rates. While you might pay more in interest during the first few years due to a higher rate, the increase in your property’s value and the equity you build can provide significant financial benefits.

For example, after ten years, you could have accumulated enough equity to sell your home for a substantial profit or use that equity to finance other investments.

Fixed Monthly Payment

Financial Stability

By securing a mortgage now, you lock in your monthly payment, providing stability and predictability in your budget. Unlike renting, where monthly payments increase each year, a fixed-rate mortgage guarantees the same monthly payment for the life of the loan. This allows you to plan your long-term finances with greater confidence.

Future Refinancing

When interest rates go down, you can refinance your mortgage to reduce your monthly payments, taking advantage of more favorable market conditions. For example, if you currently have a mortgage with a 7% rate and rates drop to 5%, refinancing could significantly reduce your monthly payments, freeing up money for other expenses or investments.

Putting the Numbers in Perspective

Imagine you find a house for $600,000 in 2024.

To buy this house, you’ll need a $21,000 down payment (assuming a 3.5% FHA loan). If the interest rate is 7.6%, that gives us a monthly payment of $4,088 for principal and interest.

Adding insurance, taxes, and PMI, which are approximately $1,527 more per month, your total monthly payment would be $5,615.

Now, let’s say you decide to wait until 2028 to see if the rate “drops.”

The same property now costs $680,000. You’ll need a $23,800 down payment, but with a lower interest rate of 5%.

Your monthly principal and interest payment would be $3,524.

Adding insurance, taxes, and PMI, which would be around $1,575 per month, your total monthly payment would be $5,099.

The difference here is that if you buy in 2024, by 2028 you would have already gained $80,000 in property value.

On the other hand, if you wait until 2028, you’d be saving $516 a month in payments, which over 4 years adds up to only $24,768.

So the big question is: Would you rather gain $80,000 or save $24,768 in 4 years?

Conclusion

Deciding whether to buy a home now or wait is a personal decision that depends on several factors, including your financial goals and market conditions.

However, buying now can offer significant advantages, especially if you plan to refinance when interest rates go down.

By buying now, you can secure a property at today’s prices, start building equity immediately, and benefit from the stability of a fixed monthly payment.

Then, when rates drop (if they do), refinancing can lower your monthly payments and save you money on interest in the long term.

Remember that working with an experienced real estate agent can be invaluable in this process. An agent can provide you with up-to-date market insights, help you find the best properties, and advise you on when and how to refinance your mortgage to maximize your benefits.

If you’re ready to take the step and take advantage of today’s real estate opportunities, now is the time to act.

You won’t just be investing in a home—you’ll also be investing in your financial future.

If you’re in Massachusetts, we’d love to offer you a free consultation with a real estate agent. Get answers to all your questions and start your home-buying journey with confidence. Click here to schedule it.

![eBook How to Increase Home Value [7 Simple Ways]](https://realestatejuanc.com/wp-content/uploads/2022/03/FORMAS-WAYS-TO-INCREASE-YOUR-HOME-VALUE.png)